What Blockchains can Tell that Bankers Can't

(START HERE) An explainer for crypto in readable English

NOTE: While I wanted to write about new ways blockchains can be used for investigating scams, I decided to just start with the basics for this post.

The Thing Explainer

Cryptocurrency runs on a 'blockchain'. A public blockchain is like a globally shared spreadsheet that keeps track of who owns how much of something. For everyone to see the same information, computers that hold the spreadsheet constantly talk to each other, acting as nodes in a network. These nodes confirm or validate new batches of transactions (transaction blocks) and reach a consensus with other nodes on what the shared spreadsheet says. Every validated transaction block is linked securely to the previous block by a unique solution to hard math problems (cryptography), forming a chain all the way to the first ever block. Hence, a block - chain.

The two biggest blockchains in the world are the Bitcoin and Ethereum networks.

Public blockchains are open to everyone. Anyone can become a node, and anyone can search through all valid transactions ever added to a blockchain, using various blockchain explorers online (see below figures for examples). As it is, any searcher can just download from a node a copy of a blockchain's complete history --about 507 GB for Bitcoin and 1.2 TB for Ethereum as of September 2023. Because of this openness and transparency, cryptocurrency transactions are inherently traceable.

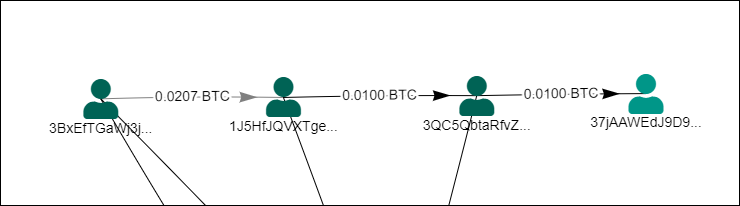

Cryptocurrency activity is pseudonymous (under a false name), not anonymous (no name). A cryptocurrency account is represented by one public address, which looks like a string of alphanumeric gibberish e.g., 0x3f50ejdhy465f8h1ddfwq8dfd99. Anyone can send cryptos to a public address and see all the cryptos it had over time, but only the holder of the private key to that address can move cryptos out of it. So, while transactions are transparent, there is no way of knowing who is sending and receiving the cryptos, just by looking at the blockchain.

We can discover the identity of a private key holder when we trace crypto transactions to places where cryptocurrencies and national currencies are exchanged. That is assuming that the receiver in the exchange knows who sent him/her the cryptos, if they’re not the same person. In most countries, money service businesses are supposed to know who their customers are. Usually the so-called Know-Your-Customer (KYC) information is only divulged by the businesses to the police and the courts, after due process.

Blockchain Proof is Good as Gold

Blockchains are immutable. They provide time-stamped, verifiable and unalterable evidence of transactions that happened. This would also mean that one can easily go back and examine any suspect transaction at any time in the past, forever. Transaction blocks are permanent once validated by a majority of nodes. It is practically impossible to go back and change historical data for say, Ethereum, unless one can convince more than 50% of about 7,873,840 Ethereum nodes around the world1.

Related to this is why public blockchains are said to be decentralized. No one entity can reverse a transaction or stop the whole network, so long as there are validator nodes. This is why cryptocurrency boosters like to say that cryptocurrency is "censorship-resistant".

Cui Bono?

When investigating a financial crime, no matter how convoluted, the most useful question to ask is: cui bono (who benefits)? You find out by following the money.

Often the money trail stops at a bank or other money service business before a legal process is needed to trace beyond it. For cryptocurrency, the trail almost always has to end in a cryptocurrency exchange, no matter how many addresses or blockchains or virtual black boxes the perpetrators launder their crypto through. The world still runs on government-issued ‘fiat’ money, so crypto thieves will still have to convert their cryptos into usable cash to buy their sports cars and mansions.

So, in both fiat money and cryptocurrency cases, you still trace to a point where you need law enforcement powers to trace further. So, what's the difference?

With crypto you can also:

Check the contents of an account in real-time. The amounts are visible to everyone, since public blockchains function as open networks.

See the other addresses, likely belonging to other victims, that sent to the same criminal crypto address.

See the transaction histories.

See the distinct actors involved in the money flow. You know they can be distinct because of their behavior or from their connections to publicly known addresses.

And many more. Like, see the accounts that pseudonymously used “smart contracts” to steal and launder cryptos (a topic for next time).

Hence, tracing cryptocurrency on the blockchain gives some more information than tracing fiat money can. Whether we can act on those information to apprehend criminals is altogether another question.

********************

UP NEXT: What are Smart Contracts and Joojoos?

aw;oiweioprfgarae;irfgiam;orfgnafgolfnge