Charting the Shadow USD Network in Asia - Tron

Part 1/3: What proportion of USD Tether on Tron is not criminal?

**********************************

Part 2/3 here:

Part 3/3 here:

**********************************

In January 2024 the UN Office of Drugs and Crime called out cryptocurrency, specifically, USDT on Tron, for enabling the explosive growth of transnational organized crime in Southeast Asia, leading to the proliferation of scam sweatshops, fraud factories, casino cities, and mafia ministates.

Per UNODC":

USDT on the Tron blockchain has become a preferred choice for regional cyber fraud operations and money launderers alike due to its stability and the ease, anonymity, and low fees of its transactions

To be clear, USDT is a virtual currency that purports to represent US dollars, while Tron is a blockchain network. A refresher on what a blockchain is, if needed:

*********

Much attention then fell on the role of the Tether company in facilitating the Asian scams cottage industry and on Tether’s barely diplomatic response to the UN report. On the other hand, Tron ‘decentralized autonomous organization’ had a similarly colored response to the UN report, claiming that Tron is simply a decentralized network with no way of controlling how it is used.

While lots of controversies have been written about USD Tether, its untransparent backing and its role in illicit financing, it seems not as much has been said about Tron, perhaps because Tron is not really understood. Even crypto watchers find Tron to have many inexplicable things about it.

For one, why is Tron a big deal? Well one reason Tron is a big deal is because Tron’s founder and biggest booster Justin Sun says so.

In going into how “decentralized” Tron really is, it will be worth looking at how Tron is actually, currently, and almost exclusively used: as an unstoppable network for moving US dollar tokens cheaply. There will be 3 installments to this.

Part 1 is an exploration of what the Tron network is really used for. Whatever that is, Tether for sure owes much of its business to Tron.

Part 2 will look into past evidence of USD smuggling from greater China through Tron. Spoiler alert, the biggest character there may turn out to not (just) be Justin Sun, but the famous MIT alumni, Samuel Benjamin Bankman-Fried.

Part 3 will talk about how anyone can today make money from helping move others’ money on Tron. It’s not just from boring blockchain “staking”, but really raking in dough. And possibly, cui bono? (who benefits?)

INTRO

Tron is another blockchain network, just like its competitors the Bitcoin, Ethereum, Solana, and other “L1” blockchains. The value today of all its native currency in free circulation, TRX (pronounced “tronix”), is only a measly $12B compared to BTC ($1.2T) and ETH ($395B), ranking it only 12th in market cap among cryptocurrencies (coingecko.com). However, market capitalization doesn’t really say how valuable a blockchain is. Market cap is only one metric among many.

In terms of number of users (number of active wallets), Tron is by far the biggest blockchain. Tron just dwarfs everyone else, as below:

Tron has highest active users daily for the past 365 days, when averaged monthly.

For a blockchain that seemingly suggests such high number of daily users though, Tron has barely any mention in the English-speaking crypto world, and particularly not in the US, the country with the noisiest and richest crypto users. Except for Justin Sun’s marketing, there hasn’t been that much interesting developments with Tron.

So who and where are the millions of people supposedly using Tron? What is it being used for?

The US dollar is moved around on Tron in the form of USD Tether (USDT). Briefly, USDT are virtual tokens pegged one-to-one in value to USD and issued on Tron and other blockchains by the company Tether, which maintains their real USD backing. USDT enjoys the stability of the USD, hence called stable-coins, while being usable on-chain and without the attendant regulations for cross-border transfers and banking. One can theoretically redeem blockchain USDT for real US dollars from the Tether company.

Tron is essentially an alternative USD payment network, much more than any other blockchain. Consider that—

More than half of all USDT minted today is on Tron

87% of the monetary value of assets on Tron network is just USDT, and much of the rest is also USD stablecoins and derivatives.

To illustrate—

There is More USDT on Tron than on Any Other Blockchain

As of July 2024, out of $114 billion total of USDT that has been issued by Tether to date, more than half is on the Tron network, or $58 billion.

Tron is really just USD, USD, USD, and nothing else.

Below is the total value of the top 10 tokens on Tron. One can see that $60B USDT simply towers over all other tokens on Tron. That is 87% of all that’s worth on Tron.

Note that the other top 10 (jUSDT, stUSDT) are just USDT derivatives, while USDD, jUSDD, TUSD and USDC are also USD stablecoins but by other companies.

(Note also that jBTC, BTT, USDD, jUSD, stUSDT, and jUSDD are all by Justin Sun companies. 🙃)

To further drive this point, below are topmost used projects on TRON:

From The DeFi Report:

When it comes to onchain activity on Tron there is Tether [USDT] ...and then there is, well, not much else. 92% of gas consumption on Tron comes from Tether

Elephant Tentacles in the Room

With supposedly millions of Tron USDT users (active addresses), where on earth are they? One cannot overemphasize how little Tron is mentioned in English-language crypto circles, news, blogs, podcasts, investment portfolios, analyses and commentary anywhere, despite Tron’s apparently gargantuan user base.

If you think there must be so many of them in Asia… you won’t be able to just casually find a random stall on the streets or in a public market in Asia that takes USDT-Tron like Visa or Alipay.

That is, unless you got to questionable places in Cambodia. In the book Number Go Up by Bloomberg journalist Zeke Faux, he finds USDT money changers in Cambodia clearly catering to the scamming cottage industry. In those, anyone can have USDT converted into cash without questions asked. Zeke even wrote about a badly-dressed customer that suspiciously looks like a scam compound boss walking out with bags of wads of cash.

There are many of those specialty USDT shops there.

Zeke happened to have shared with me the crypto addresses they told him to send USDT to— one Ethereum address 0x9D66839A4279C1dc12186D82a01E0B7655BfA6C4, and one Tron address TRVrv3GioupB7kCFN28pNgyCcFd3Dqs9fi

ETHEREUM vs TRON

You can go check yourself on Bitquery.io, but the Ethereum network address received at total of $3.7M until its owner stopped using it after nine months, while the Tron network address received $70.0M for 14 months and counting, to this day. The Tron address was also used much more frequently and had larger transactions.

While the USDT broker could have multiple Ethereum addresses and/or switched to another one, I think it’s evident that the Chinese scams industry prefer Tron a lot more than Ethereum.

Moving USDT is cheaper and faster in Tron than in Ethereum. It is for this reason that pig butchering scammers increasingly want USDT on TRON. Although, they could only induce scam victims in the US into sending USDT or USDC (another USD stablecoin) on the Ethereum network just because USDT-Tron and TRX, the native currency of Tron, are not so easily available in the US and most other “Western” countries.

It’s all Tron.

Very recently, UK-based crypto analytics firm Elliptic exposed the Cambodian financial conglomerate Huoine Pay, tied to the Cambodian prime minister’s family, for laundering at least $11B worth of USDT from pig butchering scams. (And that is just in one scam epicenter country.) A Hongkong-based crypto analytics firm Bitrace, which are longtime watchers of illicit crypto in Asia, shortly identified those Huoine crypto accounts as Tron network addresses. (Tron addresses start with a ‘T’, while Ethereum addresses start with ‘0x’).

Additionally, Bitrace found the Huoine business Tron addresses to have had billions of USDT in monthly volumes in two years. Totaling them adds up to $103 billion.

To note, the Tron address earlier from Zeke’s USDT changer does a lot of business with Huoine Pay. I’ll note here also, for later, that the money changer’s Ethereum address cashed out a lot on OKX Exchange.

Elsewhere, USDT sees heavy use in underground banking in China:

These reports didn’t mention, but it is almost for certain, that those USDTs are in the Tron network.

Smuggling money out of capital-controlled China is big business — $500B at a peak year. As discussed in my most popular post.

Tron is for ‘Gaming’

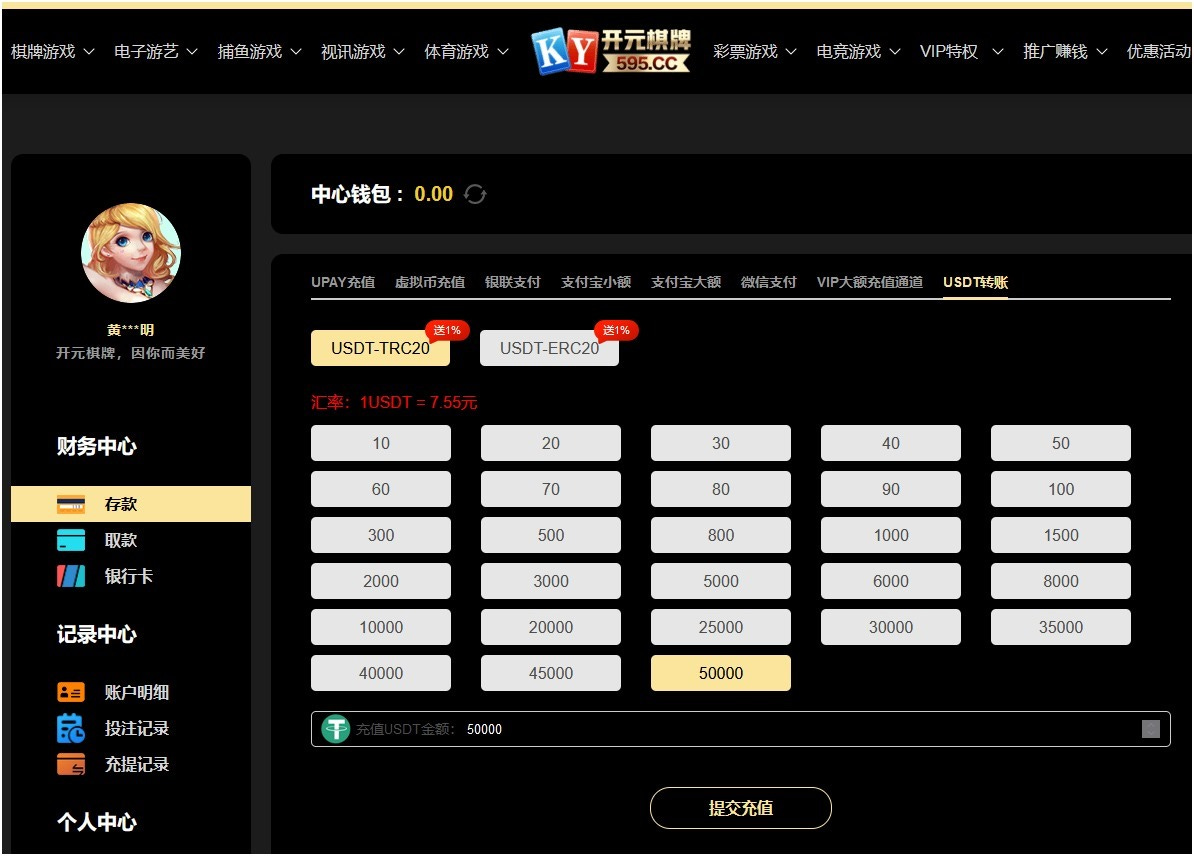

Tron is also closely associated with online gambling since its inception. In its earliest days, almost all Tron store apps were for gambling and gaming, and Tron was marketed to the gambling and ‘gaming’ industry. There are many websites for Tron casinos (tronbet.io, troncasinos.org, justbit, etc.) extolling the virtues of Tron, but let’s go to one Chinese offshore gambling website in Myanmar:

It accepts USDT from both Tron and Ethereum, but its Ethereum account address is practically collecting dust, while its Tron addresses has taken in $370k in 3 months. Additionally, the Tron address is an OKX Exchange deposit address(!)

In The Use of Cryptocurrency in Cybercrime report by Bitrace, it found that in two years between September 2021 and September 2023, a total of over $46.5B in USDT flowed into Tron addresses of “traditional” online gambling platforms (non-blockchain-based gambling).

The same report by Bitrace also surveyed money laundering, scams, phishing, thefts, arbitrage fraud, black custom profile/software-as-a-service, blockchain-based gambling, and other illicit or criminal activities in Chinese cyberspace. It included comparisons of illicit use of Tron vs Ethereum networks. Bitrace reports that:

$17B in USDT went to illegal, 3rd party payment guarantors of black and “grey” market industries via Tron in one year (vs $670M USDT on Ethereum).

$64B in USDT went to Tron addresses identified as laundering money between September 2021 to March 2023. See graph below:

Translated title: USDT Amounts Flowing into TRON Addresses with Money Laundering Risks

Bitrace comments that the inflows were relatively stable and aren’t affected by the large price swings from large events elsewhere in the crypto-verse (e.g. US Terra mega-meltdown in May 2022; the FTX bank run in Nov 2022). Hence, they reason that these TRON address activities weren’t from true crypto investors.

Money laundering is an all-season, all-weather business.

Bitrace rated Tron as “severely polluted” when compared to Ethereum:

Over $41.5B in high-risk (dirty) USDT-Tron went to crypto exchanges between January 2021 to September 2023, comprising funds from online gambling, black and grey markets, and money laundering (vs $3.3B on Ethereum).

Over $33.5B in high-risk USDT-Tron went to DeFi payment platforms mostly used in East and Southeast Asia in the same period (vs $7.04B on Ethereum)

Suspected over the counter (OTC) broker addresses took in $3.5B in USDT-Tron

This rating on Tron was seconded by TRM Labs’ The Illicit Crypto Economy Report, which says that 45% of all crypto crime (that TRM counts) in 2023 occurred on the Tron blockchain. That is close to half of $35B in crypto crime that TRM Labs counted. As Bitrace and TRM labs could only be working on incomplete information, and given how conservative blockchain analytics companies are usually in estimating crime on-chain, the true rate of illicit activity on Tron is likely only to go up.

There is another major use case for USDT on TRON. In another Bitrace report, jointly made with Chinese blockchain analytics firm SlowMist, Bitrace analyzed a Tron address exposed as a payment address for human trafficking victims in northern Myanmar wanting freedom (from either Chinese police or scam compounds). The address took in $65M, mostly received within 2 months in late 2023. It is also connected to a cluster of almost 100 known Tron addresses tied to gambling, fraud, money laundering and other illicit activities

Tron is for What?

It is hard to sum up those tens of billions of USDT discussed above from the news and Bitrace reports ($46.5B, $17B, $64B, etc.) since there are probably some overlaps between their different estimates and recycling of funds, although Bitrace very clearly delineated the distinct categories for money laundering vs gambling vs others.

Nevertheless, the total amount of USDT on Tron is not that big. Just compare Bitrace’s money laundering chart above, to the chart below, at the equivalent time periods. (Note that one chart above does not yet include other illicit categories.)

TOTAL USDT ISSUED ON TRON, MONTH BY MONTH

Yes, we might be comparing apples to oranges (counting stock vs flow), but you can still probably appreciate how a chunky proportion of the total Tron dollar value is just for gambling, grifting, laundering, scamming, ransoming, smuggling, phishing, hacking, hiding money, and trafficking in one region of the world.

To spell it out, Tron is really big at moving around USD credit for people who can’t —or aren’t supposed to— get that USD.

******************************

Self-promotion: I had an essay published in a security weekly in the Philippines about crypto scam centers there: Authorities Must Look Into POGO Cryptocurrency. Here's What We Might Learn - SecurityMatters Magazine

******************************

Up next:

Tron Part 2/3 - What did Sam Bankman-Fried do? A history of smuggling billions on-chain.

o;idmxpehp9ewuf[uefiurngueangr’o

linked to this post from my new one: https://cryptadamus.substack.com/p/trumps-transition-team-is-tethered