Charting the Shadow US Dollar Network in Asia, Tron

Part 3/3: With great profits come great responsibility? Can Tron get sued?

Apologies for the long time gap between Part 2 and this final Part 3. It’s not as if Tron is going anywhere, though.

***************

What has over $64 billion USD running within it; is run by 27 computers; was founded by someone who has ran away from US and Chinese authorities; allows one to run off with millions of dollars instantly and cheaply to anywhere; and earns investors 20-40% interest annually?

Would you want to invest in it?

Investing in Tron can be actually quite profitable — if one is willing to overlook that scammed, stolen, extorted, and sanctioned moneys could be 50% or more of its business. See Part 1 and Part 2.

This is Part 3 of 3. This might be the longest installment, so here’s the punchline upfront:

To become the high-speed, low-cost payment network for USDT, the Tron blockchain is run by a few, specialized and interconnected operators. These Tron operators don’t check illegal and criminal activities on their service, since they claim Tron is “decentralized”. On close examination, Tron’s decentralization seems less a matter of technical fact, but rather, a matter of muddying who’s making money and avoiding any accountability.

For sure, Tron is far from the only crypto project that claims that normal diligence around money transfers could not apply to them. Some people argue that all crypto experiments are just schemes to outwit regulators and law enforcement. In any case, USDT-Tron is certainly the biggest unregulated payment network in Asia right now.

Here, this post will try to disentangle, demystify and de-jargonize the decentralization talk of Tron and try to follow the money. Nothing will be proven here, since nailing down all the details requires more time, tools and legwork. This is more of a roadmap, and maybe at the end of the money trail there will be a rainbow.

Much of these aren’t news to people in crypto, but who probably haven’t considered Tron at this detail.

OUTLINE:

How Ethereum & Tron Makes Money

How to Make More Money: Staking

Form a Cartel

How to Make Even More Money: Energy Markets

Blockchains are Man-Made

What’s Seen Cannot Be Unseen

HOW ETHEREUM & TRON MAKES MONEY

People running blockchains make money not just from their ETH or TRX rising in value. One way of making money from blockchains is by becoming one of its transaction validator (“miner” for Bitcoin and the like). As a refresher, I’m paraphrasing my Thing Explainer-style primer about blockchains:

A public blockchain is like a shared spreadsheet or accounting ledger that always keeps track of who owns how much of what. Computers that update the spreadsheet constantly talk to each other, acting as nodes in a network. These nodes confirm or validate new batches of transactions and reach consensus with other nodes on what the shared spreadsheet says.

People running those computer nodes need to be compensated, preferably profit also, so that people are incentivized to help maintain this giant spreadsheet. Generally, blockchain validators earn rewards with:

(1) newly created cryptos native to that blockchain e.g., BTC in Bitcoin, ETH in Ethereum, TRX in Tron; and

(2) the transaction fees paid by users of the blockchain.

The precise mix of newly created crypto and user transaction fees getting rewarded to validators varies with different blockchains.

As a potential Tron investor who wants to earn real value, not just more of TRX tokens, you’d want to understand the business model deeper. Let’s take the Ethereum blockchain.

Running Ethereum nodes is the business of selling limited block space, i.e. the accounting entries that will be included in the next update i.e., transaction block. Node operators chase after the rewards coming from validating Ethereum transaction blocks. They then broadcast the validated transactions to other nodes.

Presumably, every node operator is an independent entrepreneur chasing after profits. And because of the clever ways the Bitcoin/Ethereum/Tron/etc. protocols work, all nodes working individually, even competitively, arrive at an agreement on the current transaction records on the giant spreadsheet.

The more nodes independently validating a transaction, the harder it is to make accounting lies on the giant spreadsheet. In fact, having more node operators is encouraged to prevent editing of the spreadsheet by any organization, authority, hacker, and other unilateral interventions. This reason is a part of why blockchains are called decentralized and “censorship-resistant” (!).

To join an open network as a validator, there is ideally no one to ask for permission from. Technically anyone can download the validation client software for free, start validating and make more money (crypto). With thousands of individual nodes (Ethereum currently has ~6,000 nodes, for example) distributed across continents, it’s virtually impossible for any one actor to manipulate or disable the Ethereum blockchain.

Does being a blockchain validator look like a sensible investment? One more point to add:

Software programs (a.k.a smart contracts) can also be built on blockchains like Ethereum , most commonly to automate financial stuff — like exchanging cryptos, tokenize stablecoins and memecoins, etc. For a little more detail how it works, see:

Validators push along the execution of these blockchain programs1, which costs more ‘gas’ fees to execute than simple ETH transfers. For example, whenever you send USDT stablecoins to someone, you actually execute the USDT software on the Ethereum blockchain to move the USDT, and therefore have to consume some of your ETH as ‘gas’. Mostly the same process goes for USDT on Tron.

Hence, blockchain programs like that of USDT stablecoins create a lot more demand and value for ETH. In the case of Tron, USDT very much makes the Tron Business exponentially more valuable, as in Part 1.

HOW TO MAKE MORE MONEY: STAKING

ETHEREUM

An additional way to make money on crypto is by Staking. It exists in so-called Proof-of-Stake blockchains like Ethereum. Basically, you lock or “stake” some amount of ETH to the Ethereum validation protocol and share in the validation rewards. The more ETH you stake, the higher your rewards.

Staking is another way to make money aside from being a validator, because in reality, running a node is not for everyone. No matter how much cheaper validating transaction blocks is supposed to be getting now2, doing it as a business proposition is still costly. Rigging up some exquisite computer server to run a node 24/7 to maximize profits is a very deliberate investment. The software clients are not welcoming to non-specialists; you’ll most probably end up just buying full-service Ethereum node packages from specialist vendors and/or rent some kind of cloud computing service. Furthermore, Ethereum validation requires some ETH staked, and 32 ETH is the minimum stake to start validating— around a US$84,000 minimum bet (2024 average).

Fortunately, you can delegate and pool your ETH staking with others in a way where you can still share in the validation rewards. Most ETH investors join cooperative pools like Rocket Pool and Lido to go over the 32 ETH threshold, or entrust their ETH to companies like Coinbase, all of whom takes care of all the details of staking and operating a node, for a small cut (management fees?).

ETH when staked directly gets locked up and is unusable often for weeks. But if you invested your ETH in staking pools, you get staked ETH tokens (stETH) in return3 to your crypto wallet. The stETH is like a certificate of deposit that digitally proves your claim to your staked ETH and its rewards, which should accrue automatically at a variable ~3% annual interest4.

Again, your passive income when validating/staking ETH comes from (1) newly created ETH as a reward, and (2) gas fees paid by ETH users for the processing of their transactions. This is aside from the price of your ETH itself. Your regular ETH is like an equity stake into the Ethereum Business5.

To note, those stETH tokens aren’t just for show in your crypto wallet. They can be traded, loaned and used as collateral in various blockchain programs and schemes, for even more income. It is as if your locked ETH is still liquid and usable. It’s why this is called “liquid staking”, and even “liquid re-staking” …

You could think that there is a real business generating validator & staking income— the business of securing the Ethereum blockchain and pushing ETH around. Well, as long as there are demand for those. The same goes for Tron income.

TRON

Many of these money-making setups in Ethereum were copied into Tron, just replace ‘ETH’ with ‘TRX’, and stETH with staked TRX, ‘sTRX’, above. Tron staking gives on average higher interest (~5%) than Ethereum staking (~3%).

If you have suspicions that Ethereum validation and staking are just monopolized in practice by a few big entities, in Tron it’s blatant. Tron has only 27 validator nodes, and Tron validation has more expensive computing requirements. sTRX is the only TRX staking pool that matters and is managed by JUST Foundation, or JUST “DAO”. There is almost only one sTRX lending operator that matters on Tron, JustLend — named after Justin Sun, naturally.

You already have hints from Part 1 where/who/what are all the activities generating the income for Tron.

Tron only has 27 validators?

Consensus validation on Tron is a little more interesting than Ethereum. You see, having to get validated by sooo many nodes all over the world, Ethereum transactions are quite slow and expensive (15 transactions per second), compared to, say, Visa’s payment network (24,000 to 65,000 transactions per second). Transaction costs can also get painfully high in times of Ethereum network congestion —which is almost all the time (~$70 to ~$200 USD at very peak times). Ethereum has been criticized as being too slow to be a global payments network since forever. Such is the trade-off with being decentralized.

FORM A CARTEL

To get fast, Justin Sun’s Tron deals with the slowness issue by reducing the number of nodes required to validate Tron transactions to a mere 27, and with so Tron transaction speeds reach up to ~2,000 per second. While there are a few thousand proclaimed Tron nodes, in Tron’s system called Delegated Proof-of-Stake nevermind, aspiring Tron validators first have to be voted by TRX stakers to become validators. Every six hours, the top 27 vote-getters become Tron “Super Representatives” (SR) that will get to validate all Tron transactions in that period6. They are the approved approvers of Tron transactions, if you will.

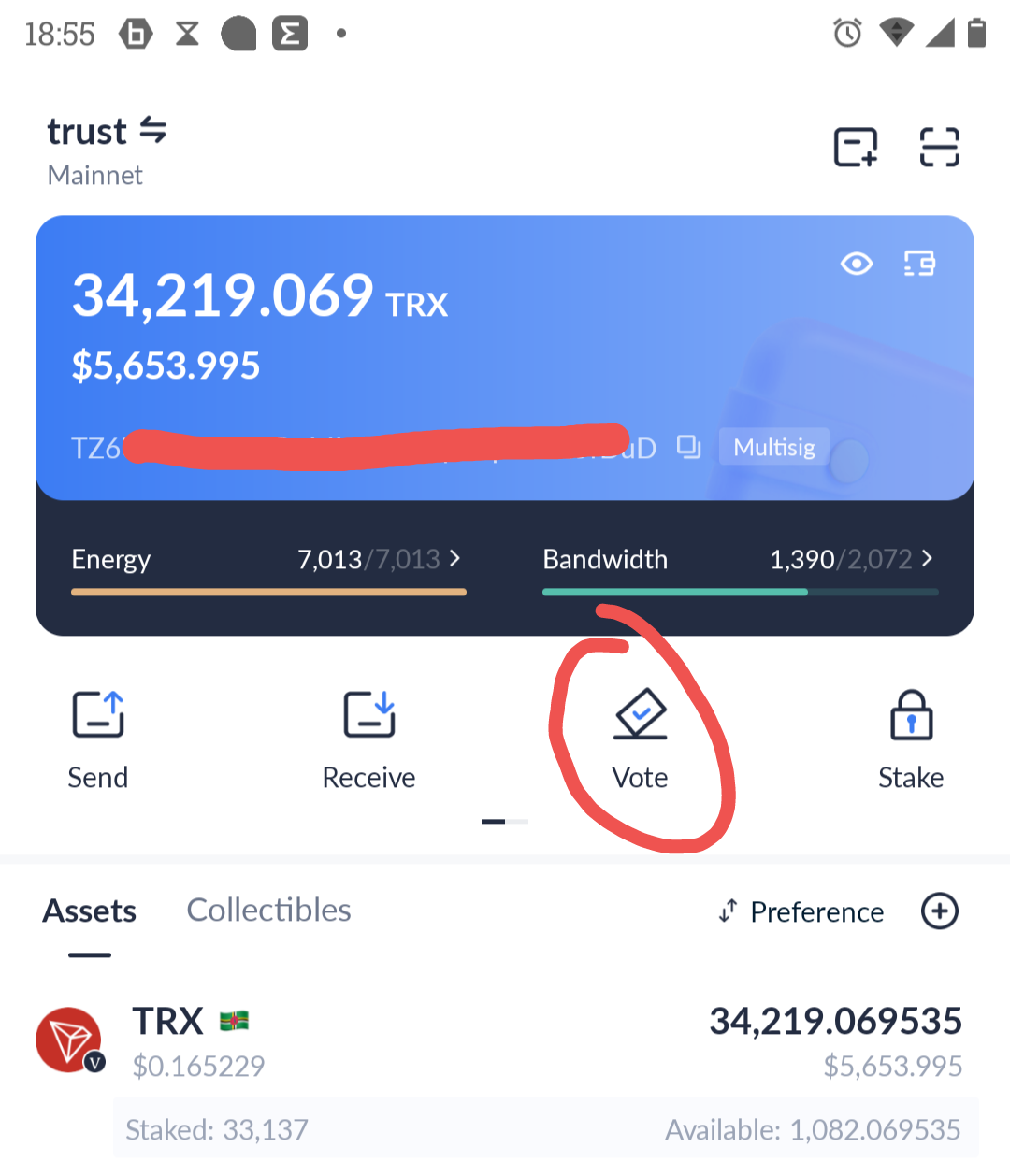

Why bother voting? Because validator nodes that become SRs can share to their voters a % cut of the validation rewards. As a potential Tron investor, you’d want to maximize your returns by voting for the Tron SRs that will bribe you with the biggest cut.

The more TRX you stake to the Tron protocol, the more votes you can have to give. If the node you vote for wins enough votes to become one of the SRs7, it will reward you in proportion to your contributed votes.

Some Tron node operators try to attract voters with cool plans for Tron development, but frankly, most TRX stakers don’t care. It all comes down to how much $$$ will you give me for my votes.

Predictably, the top SR Tron node operators promise to give away virtually 100% of their validation rewards to their voters, to stay on top as one of the top-voted SRs. Predictably, the big gets bigger, and the top 27 barely change day after day, month after month, as early as I have been checking on them since ~6 months ago. Someone can maybe make a tracker to look historically if the 27 incumbents ever change.

How can the SRs make a living then if they give away all their validation rewards?

They most likely own giant stakes of sTRX and vote for their own nodes. They hence earn by being one of the voters themselves. As to who they are, they include some of the usual suspects — Binance, OKX, some minor or lesser-known investment firms, and then Huobi (Justin Sun), Poloniex (Justin Sun), JUST Foundation (Justin Sun) and other suspected Justin Sun fronts.

Take the top-voted node operator Binance. Below is the list of Binance’s staking voters. The top 3 addresses making 95% of its voters are all Binance cold wallets.

The second-most voted node is Crypto Labs. Its majority voter and biggest beneficiary of validation rewards is the TRX Staking Pool, which is managed by the JUST Foundation… by Justin Sun. Same with #3 Poloniex (owned by Justin Sun), #4 TRONALLIANCE, #5 callmeSR, and #6 BlockAnalysis. (Huobi is somewhere further below.) Their biggest voter, single-handedly contributing >50% of vote share and rewards, is the JUST Foundation’s TRX Staking Pool8. If the 5 node operators have nothing to do with Justin Sun, it’ll be interesting to know if and how they convinced the JUST Foundation to put life-changing amounts of votes (7,705,739,014 votes) to the five of them.

Going down the list of SRs and looking at their list of voters, one will frequently see among their biggest Tron voters are the exchange wallets of Huobi, Poloniex, various suspect Justin Sun entities. I haven’t done this systematically and thoroughly, but it looks like a trend to me. And the way voting is proportioned within many individual SR nodes doesn’t look organic:

What does this all mean?

This looks like that the handful of the top Tron validator operators are also the biggest Tron stakers (investors), who are also the biggest Tron beneficiaries.

Capeesh? Wait, there’s more.

HOW TO MAKE EVEN MORE MONEY: ENERGY MARKETS

If this is already getting too long, please bear a little more. This is the part discussing how to get 20% - 40% more of guaranteed, consistent, passive income, which many US crypto investment analysts often miss with Tron.

While Ethereum needs ‘gas’ to run, Tron has 2 kinds of invented resource: ‘Bandwidth’ and ‘Energy’.

Tron Bandwidth is consumed for TRX withdrawals and for some minor state changes, like placing your votes on a node, or giving permissions to blockchain programs to your crypto wallet. Tron Energy is used for executing Tron software programs, like that for USDT stablecoin. Indeed, transferring any amount of USDT on Tron requires a lot of Energy.

Only when Bandwidth or Energy is used up would TRX be burned, at some equivalent ratio to the needed Bandwidth or Energy. Transaction fees in Tron is already cheaper than that in Ethereum, and using Tron Energy makes those instant transfers of hundreds to millions of USDT to anyone practically free.

So how do you get Bandwidth and Energy in Tron?

Primarily, by staking TRX.

Everyone who stakes TRX gets assigned Bandwidth and/or Energy, the amount depending on how much TRX they have locked9 for staking. Those are renewable Tron resources that are programmed to replenish every day.

But what if you don’t need to use your Bandwidth or Energy every day?

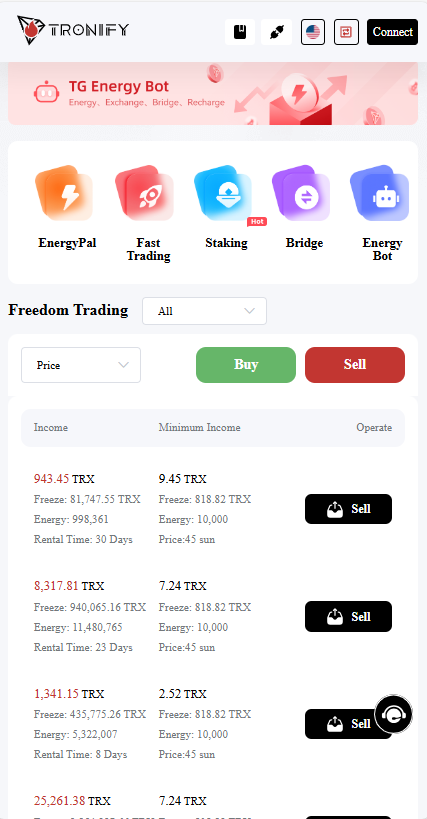

Here’s the real money-maker: You can rent and sell your Bandwidth/Energy to others.

There are thriving Tron energy ‘markets’ for renting Bandwidth or Energy, which is basically selling the rights to use someone’s Bandwidth/Energy temporarily. In those platforms, you can sell your Bandwidth/Energy or buy someone’s Bandwidth/Energy for 10 minutes, 5 hours, a week or 30 days, and so on. Energy rentals are paid for with TRX, and rental costs are dynamic, but it’s always much, much cheaper to rent Energy than to burn TRX straight up like gas fees. As a rule of thumb, renting Energy saves you 70% of TRX transaction costs.

Moreover, a few TRX staking pools and Energy rental platforms have spun up bots to automate leasing and rentals of staked TRX Energy, some which can earn you 20% - 40% more annually to your passive TRX staking income. That is on top of your Tron staking voting rewards. Tron energy rental bots take at least 30% sales commission —more than double the staking management rates in most other blockchains. The JUSTLend staking pool program by JUST Foundation seem to even take over 50%.

It’s Tron USDT transaction demand powering those incredibly high interest rates, and you should probably suspect by now who, how, where, and why the majority of that demand for energy is coming from10. (Again, in Part 1.) Heavy USDT users, like crypto exchanges and informal high-volume USDT merchants, will need hundreds of thousands to millions of Tron Energy points. (Executing one USDT transaction on Tron costs about 64,000 Energy points, equivalent to burning 13 - 27 TRX, or $2 - $5 USD.)

USDT merchants can save so much more in fees with this Tron Energy system, compared to, say, using the Ethereum blockchain11 or dealing with physical sacks of US dollars and bankers. And entities with the biggest stockpiles of staked TRX can generate so much income renting out excess Energy.

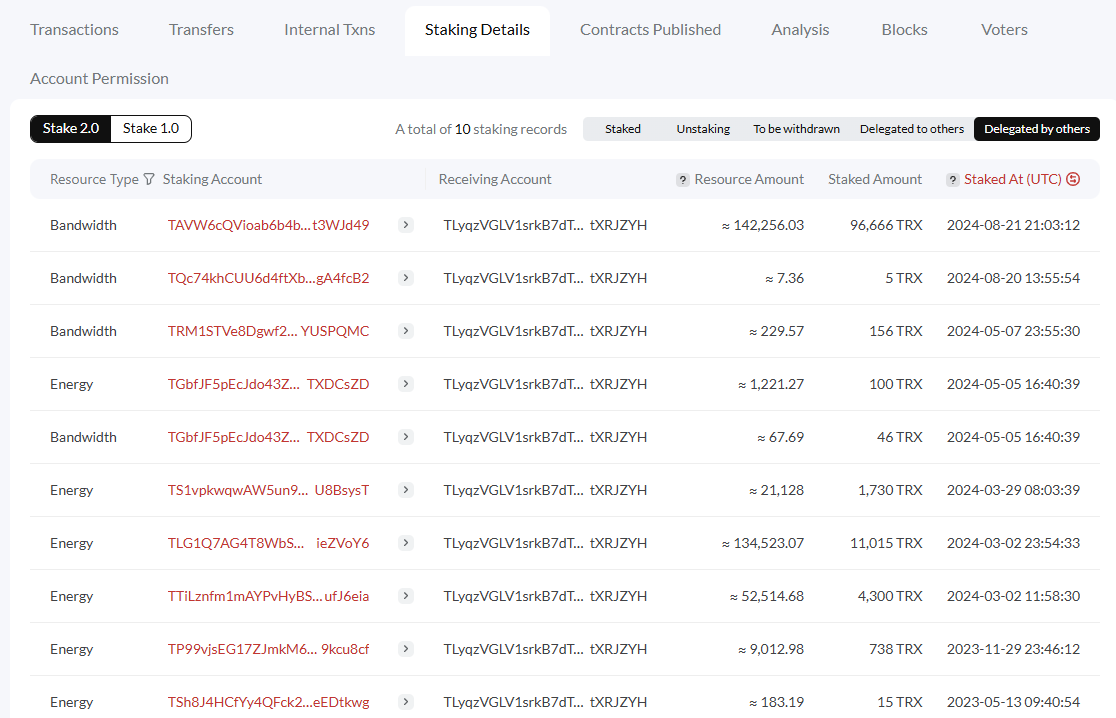

Who is delegating Tron Energy to who can be tracked on the blockchain, like on Arkham Intelligence and on TronScan under ‘Staking Details’ information tabs. With the right tools, perhaps there could be a systematic mapping of all the Energy sources and sinks in the Tron network over time. That might reveal more interesting relationships and amazing profit margins.

I have seen high-volume Tron wallets connected to pig butchering scams getting delegated energy by others. This could be an interesting way to find connections, similar to tracing ETH gas fees on Ethereum…

BLOCKCHAINS ARE MAN-MADE

Promoters of Tron12 maintain that Tron is decentralized. That is, the operators of the Tron infrastructure have no control and cannot control others’ use of Tron. That is, they cannot be responsible for (attracting) criminal use of Tron.

In response to the UN report saying that USDT on Tron has become “the preferred choice for [Asian] cyber fraud operations and money launderers”, Justin Sun hit back with “professional facts”: that in essence, that UN statement is wrongheaded since Tron is decentralized and happens to be very popular.

In furthering Tron’s ‘decentralization’, Justin Sun’s Tron Foundation declared itself in early 2022 to be officially, purely, a Decentralized Autonomous Organization (DAO), by which it means a stateless, virtual mass of pseudonymous TRX crypto holders who vote on its governance — which almost becomes laughable when you start wanting to do something actually useful, like hiring employees or signing contracts, or to find someone responsible (see: How to Sue A Decentralized Autonomous Organization).

In any case, Tron developer-investors still want to capture the maximum amount of profits from all activities on Tron. They continue promoting, expanding, and designing Tron into a tax-free money-making machine, which thrives on the perpetual demand for unregulated, cross-border, pseudonymous US dollar stablecoins. They are continually improving the product-market fit, so to speak.

Despite its size, Tron has the fewest active developers among major blockchains, a mere ~10 daily (see on TokenTerminal), meaning that Tron’s development is very likely concentrated to a handful of entities. As discussed, Tron also technically needs only 27 validators, whose relatively high computing requirements —and connections to whales— makes them somewhat a specialized and exclusive club.

Given their central role, well-capitalized operations, and profit margins between the vertically and horizontally integrated Tron conglomerates / DAOs … is it truly impossible to also deputize Tron node operators to have anti-money laundering controls?

There are ideas about having regulatory supervision embedded into blockchain technologies in a way that is technically feasible. It’s especially doable with Tron, I reckon. Reportedly, barriers to doing so more have to do with cultural mindset of the crypto community and also the regulators themselves than with technical feasibility. Simply put, if they want to, they can.

WHAT’S SEEN CANNOT BE UNSEEN

Tron recently partnered with both Tether and blockchain intelligence firm TRM Labs to form the T3 Financial Crime Unit, that, to quote Justin Sun: “sends a clear message that illicit activity is not welcome in our industry.” TRM Labs had previously publicized the report saying that biggest bulk of criminal crypto is on Tron.

I have 2 comments on this:

One, the Tron DAO certainly did not hold a public vote to let Justin Sun enter such an agreement. Likely because Justin Sun doesn’t actually need to ask the TRON DAO for consent about the big decisions concerning Tron. This is not the only time this happened.

Two, while the partnership is a good first step, it’s unclear what will be Tron’s contribution to this trifecta. Sharing technical knowledge and publishing sternly worded statements are good first steps, but would Tron (validators) be deputized soon to block scam and illicit transactions? Blacklists?

What about sanctions screening? For instance, consistently among the 10 top Energy-consuming programs (smart contracts) on Tron, aside from USDT and Justin Sun entities, are a US-sanctioned Iranian crypto exchange Nobitex and a curious Russian crypto gaming site. This Cryptocalypse post has more about how US-sanctioned Iranian entities are being allowed to use USDT by Tether.

Businesses that process money for others have obligations that governments impose, as a matter of public good or national security, especially if massive volumes are involved. Is it too convenient that the way Tron DAO found to facilitate high-speed, low-cost, no size limit transmission of US dollar credits at amazing profit margins is (still) decentralized and (therefore) exempt from those obligations? To law scholars, DAOs are “promising organizational innovations as long as they are not constructs for risk-taking without liability.”

What’s seen cannot be unseen. Would the tri-partnership make the 27 Tron SR nodes more liable now for money laundering? Actually, are they already liable for all the money laundering, illegal gambling, grifting, scamming, ransoming, smuggling, phishing, hacking, tax evasion, and human trafficking through USDT on Tron all this time?

**********

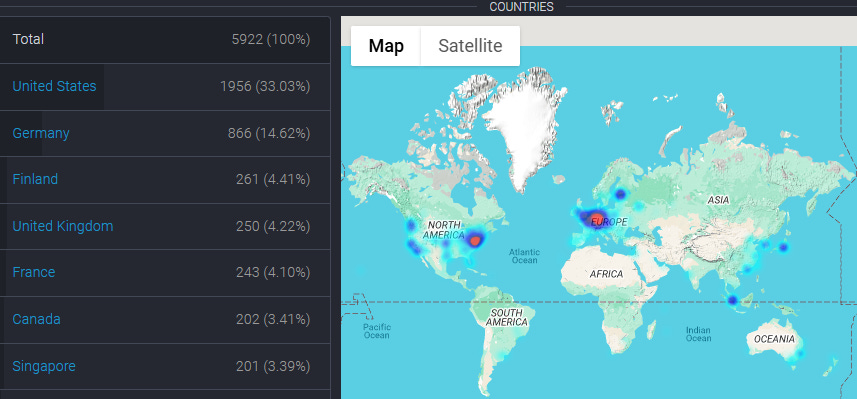

It’s fun to wonder about those questions, because ironically, 2 of the top 3 countries with the most (candidate) Tron nodes are in the US and China, both of which are either ban or block13 usage of Tron. See all Tron node locations and IP addresses here: https://tronscan.org/#/blockchain/nodes

Interestingly, many of the Tron nodes are in Cambodia, where the human trafficking & pig butchering crypto scam industry is state sanctioned and still expanding as of Nov 2024. Talk about short supply chains…

asdafgtagana;sdfogvni’aogj;odfgn;asj’oijfg;oasdijvuhgilrkljarefgroijarfgn

***********

Up next: 99% of Pig Butchering Scammers Use This Crypto Exchange. Here’s Why. (Part 1 of X)

A “smart contract”, to use a crypto insider jargon

compared to Proof-of-Work blockchains, like Bitcoin

stETH is “trademarked” to the Lido pool. Other staking pools will have various names, e.g., rETH when staking with Rocket Pool. Same difference.

Denominated in ETH, mind you, which itself fluctuates in price against the US dollar, so you have currency risk.

Disregard the US-centric debate of whether ETH is an investment security or not.

TRX stakers don’t have to vote every 6 hours; they just set it and forget it using their crypto wallets, which will vote for the same node again and again until manually changed.

also, SR ‘Partners’, see Tron documentation

The TRX Staking Pool takes in TRX from many users to stake their TRX for them. I’m not sure if sTRX staking pool takes a cut, like the LIDO and Rocket ETH staking pools. I didn’t look into the biggest TRX stakers into the pool, but I won’t be surprised if they’re the familiar entities in crypto.

Locking, meaning, you cannot use the TRX as is while staked. Initiating “un-staking” action requires 14 days now.

For sticklers: Unlike Ethereum, all Tron validator/staking income comes only from newly created TRX and none from user transaction fees. All TRX consumed as transaction fees are burned or permanently destroyed. Doing so decreases circulating TRX supply, which still boosts or maintains TRX value for its investors, so long as TRX demand remains constant. TRX holders are paid for by deflation.

To crypto people: Layer 2 solutions on Ethereum are supposed to be much, much cheaper than Tron. But I bet the Western crypto analysts who make those comparisons don’t take into account the cost reductions from the Tron Energy system. It won’t be captured on TokenTerminal.

Again, mostly Justin Sun / Tron Foundation / Tron DAO

US regulators routinely go after unregistered investments offered to the US public. The way virtual investment services can avoid being targets of US regulatory action is by blocking US IP addresses, so they can plead that US authorities have no jurisdiction over them, because they don’t serve the US market. (That reasoning wasn’t enough for Binance.) The websites of all those TRX staking pools, energy markets, and DAOs block US IP addresses.